Mexico´s power sector now offers a number of short-term business investment opportunities

In this regard, we’ve outlined

the highlights of the Mexico’s

new power sector:

1. Legal separation of each

activity (from generation

to retail).

2. A new competitive

Wholesale Electricity

Market conducted by the Mexican

System Independent Operator,

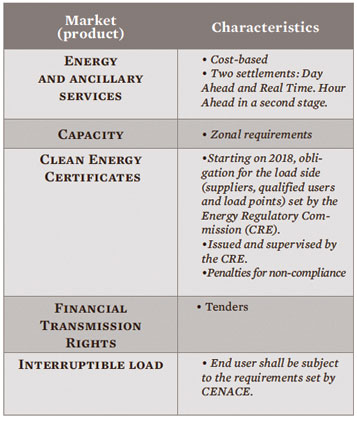

named National Power Control Center (CENACE). The main components, products and

characteristics of the WEM may be identified in the following

chart:

3. The Law sets forth the following categories

of Wholesale Market participants:

(I) Generators (>0.5 MW require a permit);

(II) Suppliers (Types: Basic, Qualified and for

Emergencies); (III) Marketers; and (IV) Qualified

Users (>1 MW of aggregate consumption

by August 12, 2016).

4. The electric grid remains under the

control of CFE, nevertheless, the Law

allows CFE to enter into “association” Private-

Public Partnership (PPP), Joint Ventures

(JV) among others, with investors in order to

build and operate transmission grid and distribution

networks.

5. The Law foresees Grandfather rights, thus,

those who held an “old regime” permit for

self-supply, cogeneration, small production, independent

power production or to import and export

power, may continue operating as in the old regime.

6. The Law sets forth new provisions that

regulate the social impact of power projects

(new legal regime), specifically in local and

indigenous communities.

7. CFE is transformed into a state productive

company, split in subsidiaries: Several power

companies one for each area: Transmission, Distribution,

Basic Supplier, Qualified Supplier, Fuels

and Gas (named “CFEnergia”) and CFE Internacional.

None of its assets shall be privatized.

With these reforms, Mexico’s power sector now

offers a number of short-term business investment

opportunities, namely:

1. The first long term power auction called by

CENACE, regarding the supply of capacity,

power and clean energy certificates for the “Basic

Supplier” (CFE), in order to sign Power Purchase

Agreements (PPA) with a term of 15 or 20 years.

The auction is currently taking place.*

2. During the second quarter of 2016 an international

tender shall take place regarding

to the building and operating of a 600 km transmission

power line with a value of USD$1.2 billion

in order to transport wind and hydroelectric

power from the south to the center of Mexico,

which shall be conducted by the CFE.

3. The WEM is open, thus new power transactions

are available, such as Generation selling

power to Qualified Supplier, Basic Supplier or

direct to the WEM; Qualified suppliers marketing

power to qualified users; among others.

4. New services, like energy management

for qualified users or energy management

for assets.