The Mexican Energy Reform opens and allows participation

of private companies in hydrocarbon and electricity projects,

which prior to 2013 where completely banned to private investment

and where carried out only by the Mexican State.

Mexican government goal is to attract private companies to invest

in the Mexican energy industry.

As of today, Mexican government has already called for Round

One, the first one out of a series of Rounds aimed to attract private

investments in hydrocarbon exploration and extraction matters.

Additionally, the National Power Control Center (CENACE) has call

for the first long term electric auction, which purpose is to award contracts

for the purchase and selling of power, cumulative electric power

and clean energy certificates.

Mexico´s potential. Oil and gas resources.

Investment opportunities

All tenders included so far in Round One have as main goal to attract

potential investors and increase oil production in 500 thousand barrels

for 2018 and 1 million barrels for 2025.

According to evaluations made, up to January 1, 2015, Mexican oil

resources that have not been discovered, but may be potentially recovered

are estimated in 112,834 MMbpce (billions barrels) of crude oil

equivalent, out of which 52,629 MMbpce (47%) are conventional resources

and 60,205 MMbpce (53%) are non-conventional resources.

» Exploration and Extraction Plan

The Plan contemplates an exploration

and extraction surface of

235, 070. 0 km2 and establishes

four bidding rounds for exploration

and extraction fields and

areas to be executed from 2015 -

2019 with an average of an equivalent

of 104,778.6 Billion Barrels

of Crude oil.

» Exploration & Extraction

Plan / Round One

Includes:

• 109 exploration

blocks and 60

extraction fields

covering a surfac e

of 28,500 km2.

• Prospective resources

of an equivalent of

70,095.3 billion

barrels of crude oil.

• Fourth tender

under process .

» Exploration

and Extraction Plan /

Round One / Fourth tender

• Ann ounc ed by CNH on

December 17, 2015.

• Includes 10

contractual areas

for offshore exploration

and extraction contrac

ts in deep waters.

• Prospective resources

of 10,537.3 billion

barrels.

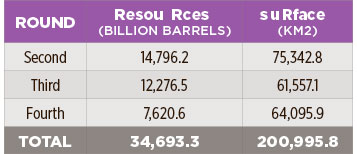

» Coming Rounds / Two, Three and Fourth

Three additional Rounds are pending to be called.

These Rounds will include total resources of approximately

34,693.3 billion barrels which will be

tendered as follows:

» PEMEX assignments

Petróleos Mexicanos (PEMEX) was given preference

over certain exploration and extraction fields

in which it had technical, performance and financial

skills for operation.

• 489 allocation’s

given to PEMEX.

• 20,589 billion barrels

of crude oil equiva lent

of 2P reserves.

• 23,447 billion barrels

of crude oil equiva lent

of prospective resources.

Hydrocarbon Law allows PEMEX to migrate

those assigned fields, prior approval of National

Hydrocarbons Commission (CNH), to the new exploration

and extraction contracts. In 2015, CNH

has already approved to migrate some developed

onshore and offshore fields with 2P reserves of approximately

2,211 billion barrels.

Additional undeveloped fields are expected to be

farmed out by PEMEX with 2P reserves of approximately

296 million barrels and 3P reserves of 1,007

billion barrels:

CNH will publish an invitation to tender in which

private investors will be able to compete to associate

with PEMEX for those areas.

» Midstream and Downstream

Private investment will be required for: (i) storage

terminals; (ii) railroads lines; (iii) pipelines; (iv)

highways; (v) ports; (vi) service stations.

» Natural Gas / Current infrastructure

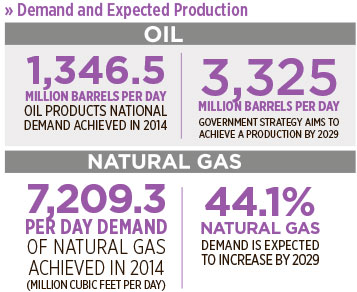

Natural gas demand has increased since 2004 and is

expected to reach 10,390.3 million of cubic feet per

day by 2029.

» Natural Gas / Transportation

and Storage System Plan

Which includes 12 different pipeline projects for

more than 5,150 km of gas pipelines and investments

of approximately 9,056 billion USD.

The above mentioned projects will be reflected as

follows once executed.

Additionally, 8 projects are to be executed by the

Federal Electricity Commission (CFE) in order to

supply natural gas to new power generation plants

in other Mexican regions.

A complete legal framework has been issued and is fully in force to strength the legal certainty for companies so they might come and participate in the tender and auction procedures

Mexico´s potential.

Electric energy

investment opportunities

Between 2004 - 2014 the gross consumption of electric

energy increased 2.9% while the forecast for the period

2015 - 2029 presents an annual increase of 3.5%.

Maximum demand forecast is expected to increase

for the period 2015 - 2029 in an annual rate

of 3.8%, meaning 69.846.9 MWh.

In order to attend national consumption and

the demand of electric energy the Federal Government

intends to expand the National Electric System

to meet a requirement of 59,985.6 MW for the

period 2015 - 2029 (56.9% with new projects).

In addition, the Federal Government expects to increase

the electric transmission system. Between 2015

- 2029 construction of 24,599 km of electric lines is expected

as well as 410 km of transmission works.

The electric sector prospective program contains

approximately 21 projects to be tendered between

2016 - 2019.

Mexico has a great potential for investment in the

oil, gas and electric energy industries having a considerable

amount of resources. Activities related to

the hydrocarbons and electric energy sectors have

been completely open for investment and private

participation. A complete legal framework has been

issued and is fully in force to strength the legal certainty

for companies so they might come and participate

in the tender and auction procedures.